Quant Commodities Fund - Growth Option - Regular Plan

| Category: Equity: Thematic-Others |

| Launch Date: 27-12-2023 |

| Asset Class: Equity |

| Benchmark: NIFTY Commodities TRI |

| Expense Ratio: 2.43% As on (31-07-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 5000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 372.11 Cr As on (31-07-2025) |

| Turn over: - |

12.3511

-0.05 (-0.4429%)

13.01%

NIFTY Commodities TRI 12.41%

PERFORMANCE of Quant Commodities Fund - Growth Option - Regular Plan

Scheme Performance (%)

Data as on - 29-08-2025Yearly Performance (%)

Fund Managers

Mr. Sandeep Tandon

Investment Objective

The objective of the scheme is to generate long-term capital appreciation by creating a portfolio that is invested predominantly in Equity and Equity related securities of companies engaged in commodity and commodity related sectors. There is no assurance that the investment objective of the Scheme will be realized.

NAV & Lumpsum details( Invested amount 1,00,000)

| NAV Date | NAV | Units | Market Value |

Returns (%) |

|---|---|---|---|---|

| 28-12-2023 | 10.0674 | 9933.0512 | 100000 | 0.0 % |

| 29-01-2024 | 10.7751 | - | 107030 | 7.03 % |

| 28-02-2024 | 11.1595 | - | 110848 | 10.85 % |

| 28-03-2024 | 11.3852 | - | 113090 | 13.09 % |

| 29-04-2024 | 12.6698 | - | 125850 | 25.85 % |

| 28-05-2024 | 12.3962 | - | 123132 | 23.13 % |

| 28-06-2024 | 13.1483 | - | 130603 | 30.6 % |

| 29-07-2024 | 14.2889 | - | 141932 | 41.93 % |

| 28-08-2024 | 14.5432 | - | 144458 | 44.46 % |

| 30-09-2024 | 15.1071 | - | 150060 | 50.06 % |

| 28-10-2024 | 13.9797 | - | 138861 | 38.86 % |

| 28-11-2024 | 13.8057 | - | 137133 | 37.13 % |

| 30-12-2024 | 13.6736 | - | 135821 | 35.82 % |

| 28-01-2025 | 12.0193 | - | 119388 | 19.39 % |

| 28-02-2025 | 11.405 | - | 113286 | 13.29 % |

| 28-03-2025 | 12.2673 | - | 121852 | 21.85 % |

| 28-04-2025 | 12.4953 | - | 124116 | 24.12 % |

| 28-05-2025 | 13.0117 | - | 129246 | 29.25 % |

| 30-06-2025 | 13.5338 | - | 134432 | 34.43 % |

| 28-07-2025 | 13.0716 | - | 129841 | 29.84 % |

| 28-08-2025 | 12.4058 | - | 123227 | 23.23 % |

| 29-08-2025 | 12.3511 | - | 122684 | 22.68 % |

RETURNS CALCULATOR for Quant Commodities Fund - Growth Option - Regular Plan

Growth of 10000 In SIP (Fund vs Benchmark)

Growth of 10000 In LUMPSUM (Fund vs Benchmark)

Rolling Returns

Rolling returns are the annualized returns of the scheme taken for a specified period (rolling returns period) on every day/week/month and taken till the last day of the duration. In this chart we are showing the annualized returns over the rolling returns period on every day from the start date and comparing it with the benchmark. Rolling returns is the best measure of a fund's performance. Trailing returns have a recency bias and point to point returns are specific to the period in consideration. Rolling returns, on the other hand, measures the fund's absolute and relative performance across all timescales, without bias.

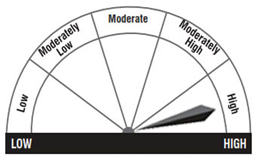

Riskometer

Key Performance and Risk Statistics of Quant Commodities Fund - Growth Option - Regular Plan

| Key Statistics | Volatility | Sharpe Ratio | Alpha | Beta | Yield to Maturity | Average Maturity |

|---|---|---|---|---|---|---|

| Quant Commodities Fund - Growth Option - Regular Plan | - | - | - | - | - | - |

| Equity: Thematic-Others | - | - | - | - | - | - |

PEER COMPARISION of Quant Commodities Fund - Growth Option - Regular Plan

| Scheme Name | Launch Date |

1-Year Ret (%) |

2-Yrs Ret (%) |

3-Yrs Ret (%) |

5-Yrs Ret (%) |

10-Yrs Ret (%) |

|---|---|---|---|---|---|---|

| Quant Commodities Fund - Growth Option - Regular Plan | 27-12-2023 | -14.54 | 0.0 | 0.0 | 0.0 | 0.0 |

| Sundaram Services Fund Regular Plan - Growth | 21-09-2018 | 4.22 | 18.12 | 17.53 | 23.2 | 0.0 |

| HDFC Defence Fund - Growth Option | 02-06-2023 | 2.05 | 38.4 | 0.0 | 0.0 | 0.0 |

| ICICI Prudential Commodities Fund - Growth Option | 05-10-2019 | 1.34 | 16.8 | 19.15 | 29.59 | 0.0 |

| ICICI Prudential India Opportunities Fund - Cumulative Option | 05-01-2019 | -0.06 | 21.07 | 22.59 | 28.32 | 0.0 |

| ICICI Prudential Exports & Services Fund - Growth | 01-11-2005 | -0.08 | 20.34 | 20.32 | 22.31 | 12.87 |

| ICICI Prudential Housing Opportunities Fund - Growth | 18-04-2022 | -0.12 | 17.23 | 17.46 | 0.0 | 0.0 |

| Edelweiss Recently Listed IPO Fund Regular Plan Growth | 16-02-2018 | -0.73 | 14.59 | 14.95 | 19.14 | 0.0 |

| Franklin India Opportunities Fund - Growth | 05-02-2000 | -0.76 | 29.41 | 28.8 | 28.04 | 16.29 |

| SBI COMMA Fund - REGULAR PLAN - Growth | 05-08-2005 | -6.83 | 16.86 | 13.99 | 19.98 | 16.0 |

PORTFOLIO ANALYSIS of Quant Commodities Fund - Growth Option - Regular Plan

Asset Allocation (%)

| Allocation | Percentage (%) |

|---|

Market Cap Distribution

Small Cap

38.76%

Others

8.07%

Large Cap

46.64%

Mid Cap

6.05%

Total

100%